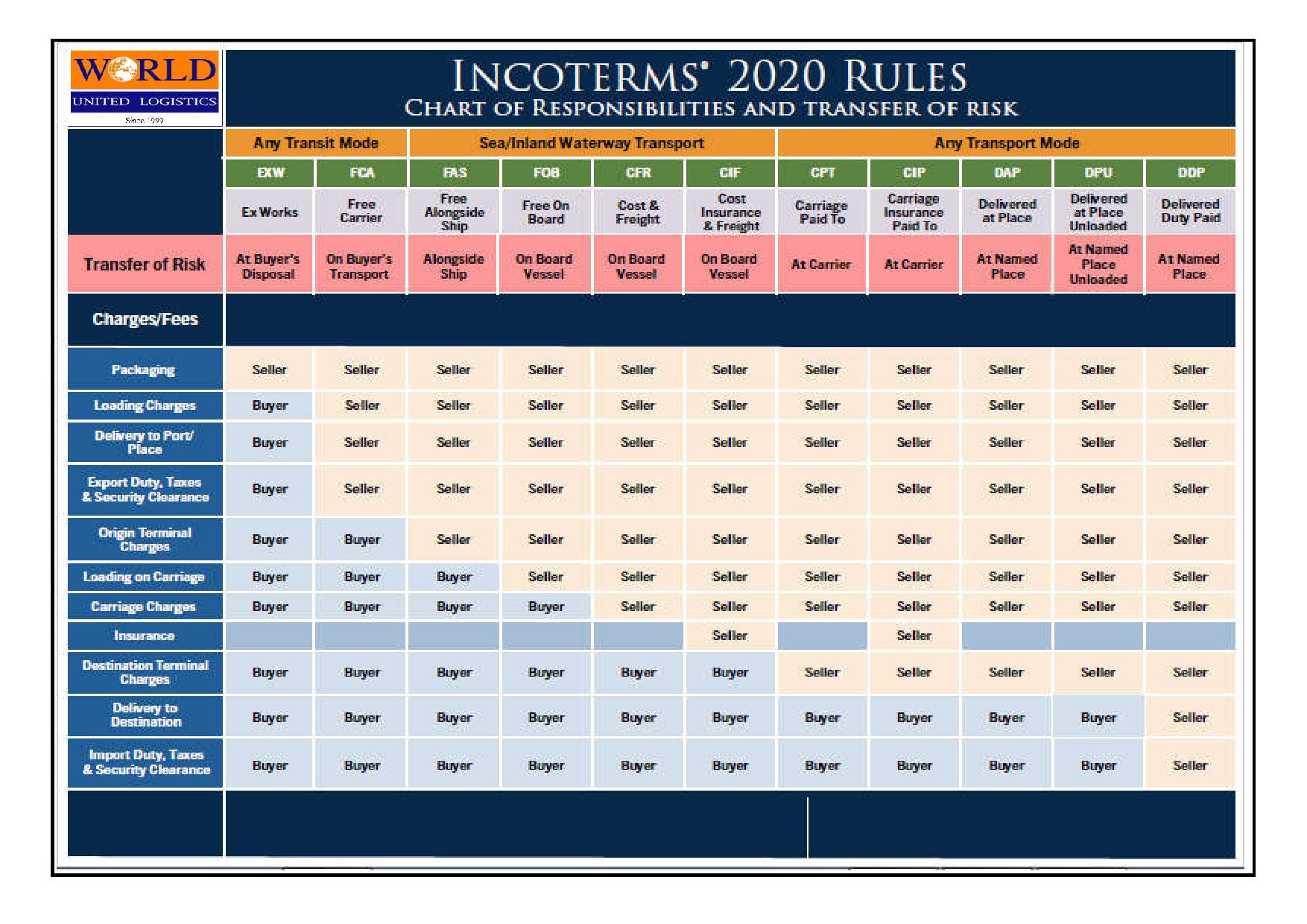

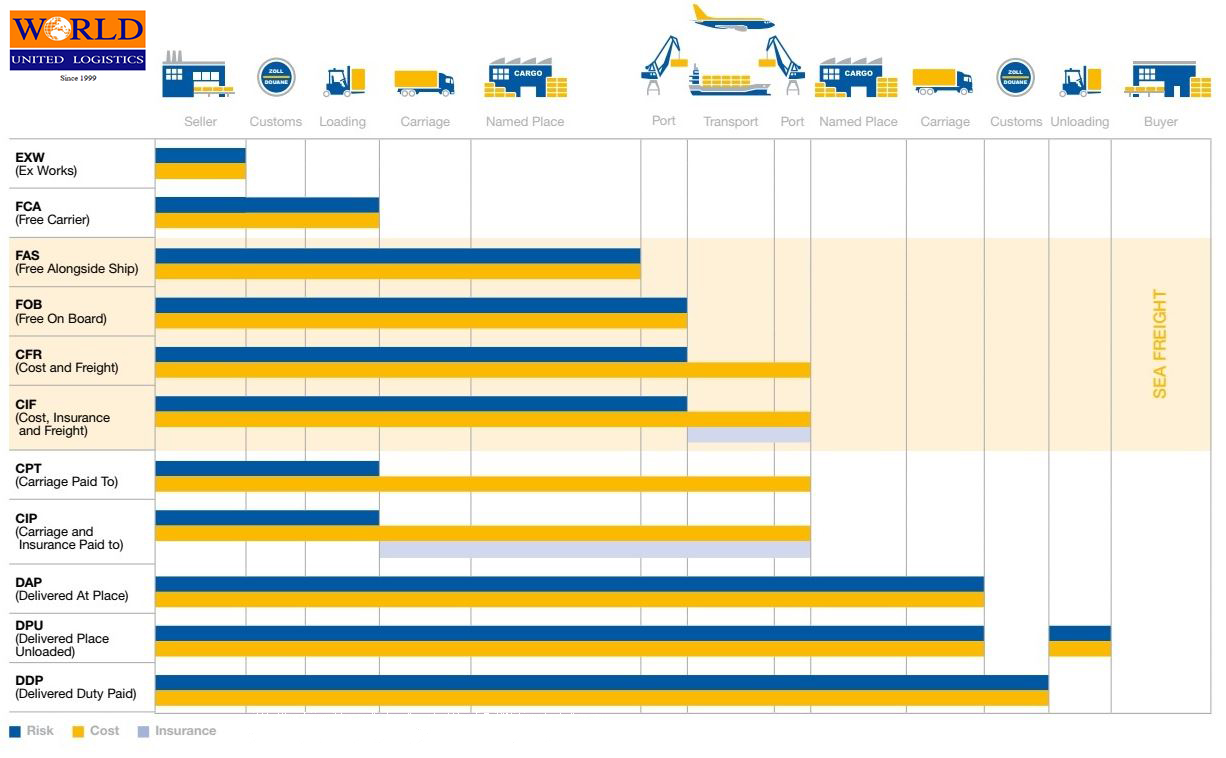

Incoterms

Ex Works (named place of delivery)

The seller must deliver the goods by placing them at the disposal of the buyer at the agreed point,if any, at the named place of delivery,not loaded on any collecting vehicle. If no specific point has been agreed within the named place of delivery, and if there are several points available , the seller may select the point that best suits its purpose . The seller must deliver the goods on the agreed date or within teh agreed period.

Free Carrier (named place of delivery)

The seller must deliver the goods to the carrier or another person nominated by the buyer at the named point,if any,at the named place ,or procure good so delivered.

Free Alongside Ship (named place of delivery)

The seller must deliver the goods either by placing then alongside the vessel nominated by the buyer at the loading point, if any,indicated by the buyer at the named port of shipment or by procuring the goods so delivered.

Free On Board (named place of delivery)

The seller must deliver the goods either by placing them on board the vessel nominated by the buyer at the loading point ,if any,indicated by the buyer at the named port of shipment or by procuring the goods so delivered.

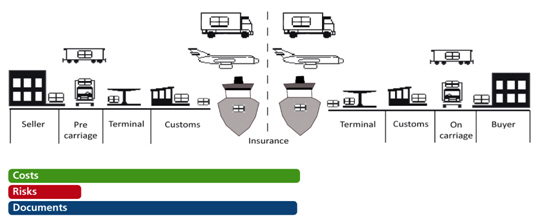

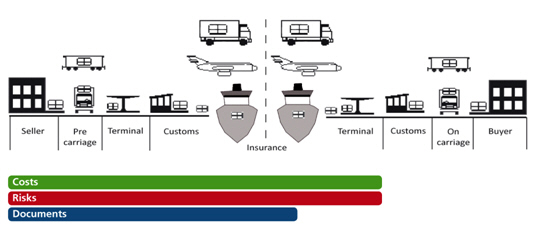

Carriage Paid To (named place of delivery)

The seller must deliver the goods by handing them over to the carrier contracted in accordance with Carriage T&C or by procuring the goods so delivered. In either case the seller must deliver the goods on the agreed date or within the agreed period.

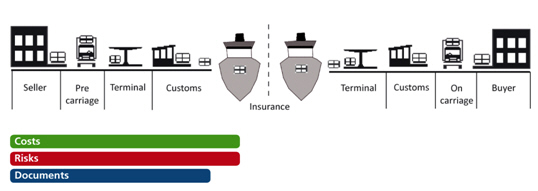

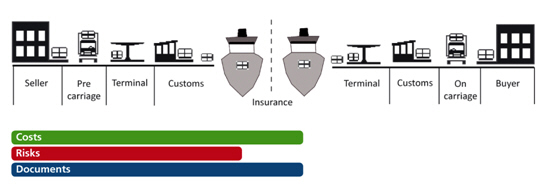

Cost and Freight (named place of delivery)

The seller must delivery the goods either by placing them on board the vessel or by procuring the goods so delivered. In either case ,the seller must delivery the goods on the agreed date or within the agreed period and in the manner customary at the port .

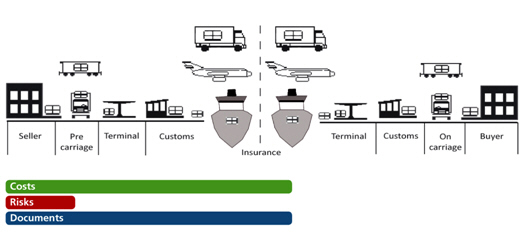

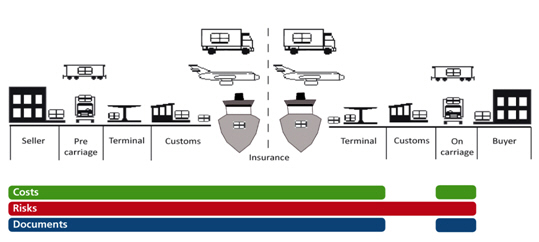

Carriage Insurence and Paid to (named place of delivery)

The seller must deliver the goods by handing them over to the carrier contracted in accordance with Carriage T&C or by procuring the goods so delivered. In either case the seller must deliver the goods on the agreed date or within the agreed period .

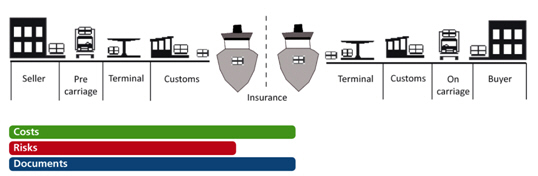

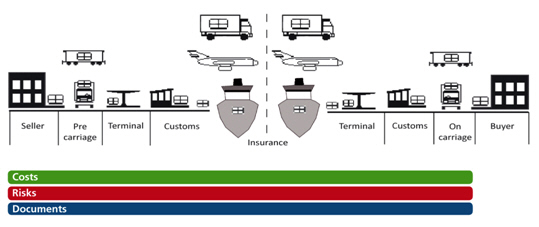

Cost, Insurance and Freight (named place of delivery)

The seller must delivery the goods either by placing them on board the vessel or by procuring the goods on the agreed date or within the agreed period and in the manner customary at the port.

Delivered Place Unloaded

The seller must unload the goods from the arriving means of transport and must then deliver them by placing them at the disposal of the buyer at the agreed point,if any,at the named place of destination or by procuring the goods so delivered. In either case the seller must deliver the goods on the agreed date or within the agreed period.

Delivered At Place (named place of destination)

The seller must deliver the goods by placing them at the disposal of the buyer on the arriving means of transport ready for unloading at the agreed point , if any,at the named place of destination or by procuring the goods so delivered. In either case the seller must deliver the goods on the agreed date or within the agreed period.

Delivered Duty Paid (named place of destination)

The seller must deliver the goods by placing them at the disposal of the buyer on the arriving means of transport ready for unloading at the agreed point,if any, at the name place of destination or by procuring the goods so delivered. In either case the seller must deliver the goods on the agreed date or within teh agreed period.